In the dynamic landscape of financial services, asset management stands as a critical element, charged with the management and growth of investment portfolios for individuals and institutions alike.

Asset managers today are grappling with an array of challenges that throttle their ability to identify market trends to best tailor investment decisions.

Enter the era of Digital Workers — a revolutionary force poised to redefine the asset management industry.

Before Digital Workers

Asset managers are no strangers to data deluge. They handle vast datasets including financial statements, market reports, and economic indicators. The manual effort required to consolidate, normalize, and parse through this information has been a significant drain on efficiency. Real-time analysis was a feat rarely achieved, and personalization for individual investor preferences remained a persistent struggle. The toll was not just on time and accuracy but also on compliance — where the intricate web of regulations necessitated a hefty investment of resources.The Transformation of Asset Management

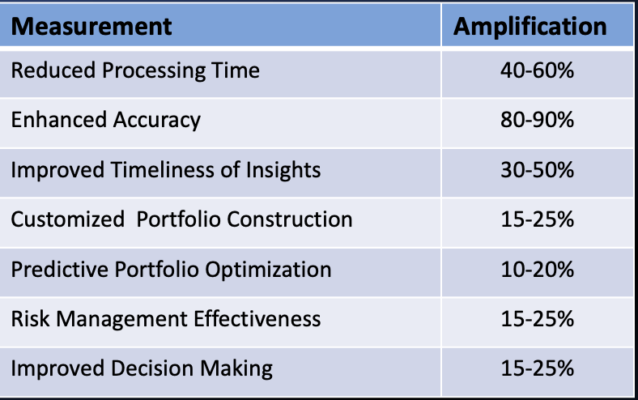

Digital Workers, armed with sophisticated algorithms and machine learning capabilities, are changing the game. They serve as force multipliers, dramatically reducing processing times and enhancing the precision of portfolio construction. Here’s how:Reduced Processing Time

By automating data-heavy tasks, Digital Workers reduce the time for portfolio construction and rebalancing, allowing asset managers to pivot towards strategic decision-making.Accuracy and Consistency

Leveraging the power to analyze large datasets rapidly, Digital Workers deliver more accurate and uniform insights, enhancing risk-adjusted returns.Real-Time Insights:

With Digital Workers on the team, portfolio managers gain access to instantaneous updates on market conditions and performance metrics, enabling agile portfolio adjustments.Personalization at Scale

Tailoring investment strategies to the unique goals and risk profiles of individual clients is now possible at scale, thanks to Digital Workers.Predictive Insights

Forecasting future market behaviors and risk profiles has become more robust, empowering portfolio managers to make proactive adjustments.The Amplification Effect in Action

The introduction of Digital Workers has not only streamlined operations but has fundamentally amplified the capabilities of human asset managers. The results speak for themselves.Enhanced Decision-Making

With the high volume of mundane work off their plates, asset managers are making more informed decisions, with improved foresight and strategic focus.Customized Client Strategies

Investors now enjoy strategies crafted to their specific needs, translating into higher satisfaction and loyalty.Risk Management

Continuous monitoring and predictive risk analytics mean potential issues are flagged and mitigated before they can impact the portfolio.Regulatory Compliance

The meticulous nature of Digital Worker auditing ensures adherence to regulatory standards without the overwhelming manual effort previously required. Digital Workers can also monitor, in real-time, organizational communications and data actions to alert for potential compliance violations.